Welcome to the latest edition of my twice-yearly newsletter. First there’s information on the oil biz, followed by notes on writing.

Oil and Gasoline

High prices cued low prices. Last summer’s high gasoline prices prompted users to reduce consumption. Add a plummeting global economy, one that requires less fuel because less business transacts, and we have oil prices a third of those last July. Although seasonal volatility going into the 2009 summer driving season is likely, oil inventory is at 357 million barrels, its highest level since 1993 and fifteen percent over the year-ago number.

A key future price variable is the Obama administration’s proposed tax code changes for finding and developing oil. If enacted, the changes are predicted to extract an additional $31.5 billion over ten years. However, this assumes the US remains an economically attractive tax regime relative to other countries, not necessarily a good assumption.

The US drilling rig count for the week ended 3/20/2009 is 1085, already down 47% compared to a high of 20 31 reached in September, 2008 . Indeed, The New York Times quotes a Cambridge Energy Research Associates study showing future supplies could fall off by eight million barrels a day within the next five years due to insufficient oil exploration and development. (http://www.nytimes.com:80/2009/03/27/business/energyenvironment/27oil.html?_r=1&ref=business)

If you’re sensitive to violent numbers, skip down to author news.

For techies, actuaries, and tax nerds—I count myself among you—the proposed changes are as follows:

- 13% tax on all oil and gas production in the Gulf of Mexico(GOM), assessed on those not already paying certain royalties;

- $4/acre annual fee on GOM leases designated as non-producing;

- end to federal funding for ultradeepwater oil and gas research and development; note that one of the largest recent US oil finds, the Jack Field in the GOM, is ultradeepwater;

- repeal expensing of intangible drilling costs, which are normal business expenses like fuel, repairs, and hauling;

- repeal of percentage depletion–depletion keeps smaller, older wells economic;

- repeal of the marginal well tax credit, a credit that allows recovery of more energy from older wells;

- repeal of enhanced oil recovery credit;

- increase geological and geophysical amortization costs;

- repeal of manufacturing tax deduction, a deduction given to all other American manufacturers. Many of these changes would hit small companies hard. (http://www.ipaa.org/news/press_releases/pr2009/2009-02-26.asp)

Author News

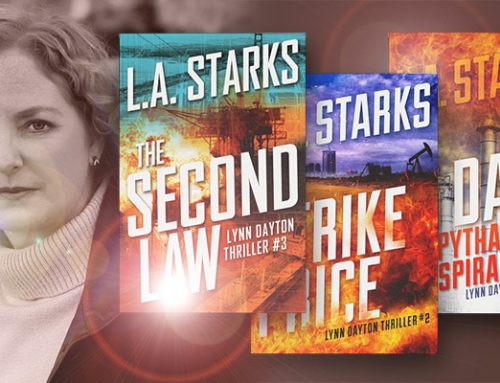

Except for a soupçon of online marketing, 13 DAYS: THE PYTHAGORAS CONSPIRACY, now flies on its own. In the last six months, it has received two more positive reviews, from Techno-Thriller Magazine and Book Cove Reviews. I continue working on the second book, with plans for a third. I’m finding the historical and cultural layers of the primary settings intriguing and deeper than expected. The stakes are just as high.

Best,

L.A. Starks

http://lastarksbooks.com